இறைவா ! ஆட்கொள்

உலகெலாம் ஆக்கி அகார உகார மகாரமான ஆதி பரம்பொருளின் பாதம் சரணம் அணுவினும் சிறிதான பெரிதினும் பெரிதான அன்பே உருவான ஆண்டவா சரணம் ஒன்றுமின்றி நின்ற போதும் ஒன்றே ஒன்றான உன்னில் ஒன்றி நிற்பதன்றி வேறொன்றும் வெண்டிலேன் நான் நின் அன்பில் லயித்து நின் அன்பில் திளைத்து நின் அன்பில் கலந்திடும் வரம் தா இறைவா !

Glossary Series : Windfall Profit

Windfall profit or Windfall Gains is an unexpected profit. For instance: winning a lottery unforeseen inheritance Shortage of Supply or Sudden Increase in Demand The main feature of the Windfall Profit is it is temporary in nature. In India, a Tax on Windfall Profit is levied depending on the

Glossary Series : Block Deal

It is a single transaction, of a minimum quantity of five lakh shares or a minimum value of Rs 5 crore, between two parties that are mostly institutional players. The transaction happens through a separate trading window. The deals happen in the beginning of trading hours for a time span

Glossary Series : Recession

A recession is a slowdown or a massive contraction in economic activities. A significant fall in spending generally leads to a recession. Such a slowdown in economic activities may last for some quarters thereby completely hampering the growth of an economy. In such a situation, economic indicators such as GDP,

Glossary Series : Securities Transaction Tax

STT is a kind of turnover tax where the investor has to pay a small tax on the total consideration paid or received in a share transaction. STT was introduced in the Budget of 2004 and implemented in Oct 2004. The objective behind the levy is to mitigate tax evasion

Glossary Series: Derivatives

A derivative is a contract between two parties that derives its value/price from an underlying asset. The most common types of derivatives are futures, options, forwards, and swaps. It is a financial instrument that derives its value/price from the underlying assets. Originally, the underlying corpus is first created which can

Glossary Series : Delisting

Delisting involves the removal of listed securities of a company from a stock exchange where it is traded on a permanent basis. Delisting curbs the securities of the delisted company from being traded on the stock exchange. It can be done either on the voluntary decision of the company or

Glossary Series : Day Trader

Day trader refers to the market operator who indulges in day trading. A day trader buys and subsequently sells financial instruments like stocks, currencies or futures and options within the same trading day, which means all the positions that he creates are closed on the same trading day. A successful

Glossary series : The Stock Market

It is a place where shares of pubic listed companies are traded. The primary market is where companies float shares to the general public in an initial public offering (IPO) to raise capital. Once new securities have been sold in the primary market, they are traded in the secondary market—where

Glossary Series: Squaring Off

Squaring off is a trading style used by investors/traders mostly in day trading, in which a trader buys or sells a particular quantity of an asset (mostly stocks) and later in the day reverses the transaction, in the hope of earning a profit (price difference net of broker charges and

Sharpe Ratio

Sharpe ratio is the measure of the risk-adjusted return of a financial portfolio. A portfolio with a higher Sharpe ratio is considered superior relative to its peers. The measure was named after William F Sharpe, a Nobel laureate and professor of finance, emeritus at Stanford University. Sharpe ratio is a

Glossary Series : Stock

A stock is a general term used to describe the ownership certificates of any company. A share, on the other hand, refers to the stock certificate of a particular company. Holding a particular company's share makes you a shareholder. Stocks are of two types—common and preferred. The difference is while

Glossary Series : Stop-loss

Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point. It is used to limit loss or gain in a trade. The concept can be used for short-term as well as long-term trading. This is an automatic order that an investor

Security-based Lending

Security-based lending is the practice of raising a loan by offering your existing investments in stocks/mutual funds/ETFs as collaterals. The loan can then be used for making purchases like real estate or personal items like cars. The only thing that this loan cannot be used for is making further security

Asset Turnover Ratio

Asset turnover ratio is the ratio between the value of a company’s sales or revenues and the value of its assets. It is an indicator of the efficiency with which a company is deploying its assets to produce revenue. Thus, the asset turnover ratio can be a determinant of a

Domestic Institutional Investors

Domestic Institutional Investors are those institutional investors who undertake investment in securities and other financial assets of the country they are based in. Institutional investment is defined to be the investment done by institutions or organizations such as banks, insurance companies, mutual fund houses, etc in the financial or real

Foreign Institutional Investor

Foreign institutional investors (FIIs) are those institutional investors which invest in the assets belonging to a different country other than that where these organizations are based. Foreign institutional investors play a very important role in any economy. These are the big companies such as investment banks, mutual funds etc, who

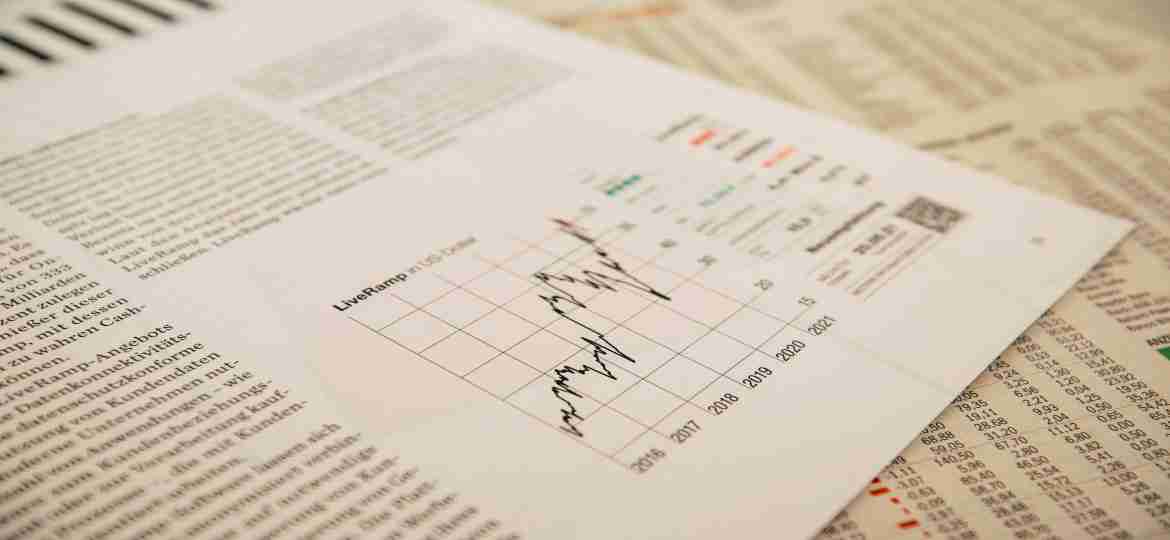

Types of Trends

Bullish Trend A 'trend' in financial markets can be defined as a direction in which the market moves. 'Bullish Trend' is an upward trend in the prices of an industry's stocks or the overall rise in broad market indices, characterized by high investor confidence. Bearish Trend 'Bearish Trend in financial

Bollinger Bands

Bollinger Bands is one of the popular technical analysis tools, where three different lines are drawn, with one below and one above the security price line. Its specific period moving average is denoted as midline to form an ‘envelope’. These lines show a band or a volatility range in which

Multibagger Stocks

Stocks that give returns that are several times their costs are called multibaggers. These are essentially stocks that are undervalued and have strong fundamentals, thus presenting themselves as great investment options. Multibagger stock companies are strong on corporate governance and have businesses that are scalable within a short span of

Margin Trading

In the stock market, margin trading refers to the process whereby individual investors buy more stocks than they can afford to. Margin trading also refers to intraday trading in India and various stock brokers provide this service. Margin trading involves buying and selling of securities in one single session. Over

Glossary Series : Employees Stock Option (ESOP)

An employee stock ownership plan or Employees Stock Option (ESOP) is a type of employee benefit plan which is intended to encourage employees to acquire stocks or ownership in the company. Under these plans, the employer gives certain stocks of the company to the employee for negligible or less costs

Insider Trading

Insider trading is defined as a malpractice wherein trade of a company's securities is undertaken by people who by virtue of their work have access to otherwise non-public information which can be crucial for making investment decisions. When insiders, e.g. key employees or executives who have access to the strategic

Relative Strength Index (RSI)

Relative Strength Index (acronym RSI) is one of the most extensively used momentum oscillators in the realm of technical analysis of stocks. It was introduced by Welles Wilder in June 1978 and its computation is explained in detail in his book New Concepts in Technical Trading System. Momentum oscillator measures

Glossary Series : Record Date

The issuing company fixes a particular date when the investor must own shares in order to be eligible to participate in corporate events like receiving dividend, bonus shares etc. This is called record date. By this date, the company identifies its shareholders and sends them dividends, bonus shares or notice

Glossary Series : Settlement Date

Settlement date is the day on which a trade or a derivative contract must be settled by transferring the actual ownership of a security to the buyer, against necessary payment for the same. After a trade order is executed, it generally takes one to three days to settle it depending

Stochastic Oscillator

Stochastic Oscillator is one of the important tools used for technical analysis in securities trading. This technique was developed in late 1950s by Dr. George Lane. The indicator picks one observation point in current base and refers to all points in the defined range from where the highest and lowest

Moving average convergence divergence (MACD)

Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis. This was developed by Gerald Appel towards the end of 1970s. This indicator is used to understand the momentum and its directional strength by calculating the difference between two time

Volatality

It is a rate at which the price of a security increases or decreases for a given set of returns. Volatility is measured by calculating the standard deviation of the annualized returns over a given period of time. It shows the range to which the price of a security may

Glossary Series : Penny Stocks

Penny stocks are those that trade at a very low price, have very low market capitalisation, are mostly illiquid, and are usually listed on a smaller exchange. Penny stocks in the Indian stock market can have prices below Rs 10. These stocks are very speculative in nature and are considered

Glossary Series : Securities Transaction Tax

STT is a kind of turnover tax where the investor has to pay a small tax on the total consideration paid or received in a share transaction. STT was introduced in the Budget of 2004 and implemented in Oct 2004. The objective behind the levy is to mitigate tax evasion

Glossary Series : Bonus Shares

Bonus shares are additional shares given to the current shareholders without any additional cost, based upon the number of shares that a shareholder owns. These are company's accumulated earnings which are not given out in the form of dividends, but are converted into free shares. The basic principle behind bonus

Glossary Series : Stock Split

When a company declares a stock split, the number of shares of that company increases, but the market cap remains the same. Existing shares split, but the underlying value remains the same. As the number of shares increases, price per share goes down. Stock split is done to infuse liquidity

Glossary Series : Monopoly

A market structure characterized by a single seller, selling a unique product in the market. In a monopoly market, the seller faces no competition, as he is the sole seller of goods with no close substitute. In a monopoly market, factors like government license, ownership of resources, copyright and patent

Glossary Series : Cash and Carry Trade

Cash and carry trade is an arbitrage strategy which involves buying the underlying asset of a futures contract in the spot market and carrying it for the duration of the arbitrage. Traders use this strategy to take advantage of the difference between the price of the underlying security and its

Glossary series : Return on Equity

The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings. Return on equity signifies how good the company is in generating returns on the investment it received from its shareholders. Mathematically, Return on Equity = Net

Glossary Series : Return on Capital Employed

Return on Capital Employed or RoCE essentially measures the earnings as a proportion of debt+equity required by a business to continue normal operations. In the long run, this ratio should be higher than the investments made through debt and shareholders’ equity. Otherwise diminishing returns shall render the business unsustainable. This

Glossary Series : Dividend

Dividend refers to a reward, cash or otherwise, that a company gives to its shareholders. Dividends can be issued in various forms, such as cash payment, stocks or any other form. A company’s dividend is decided by its board of directors and it requires the shareholders’ approval. However, it is

Glossary Series : Dividend Yield

Dividend yield is the financial ratio that measures the quantum of cash dividends paid out to shareholders relative to the market value per share. It is computed by dividing the dividend per share by the market price per share and multiplying the result by 100. A company with a high

What is India VIX

If you have been a market investor for some time, you would have come across the term - India VIX. But what does India VIX really tell us and why is it important for traders and investors? Let's understand. The India Volatility Index in short is termed India VIX. It indicates the degree of volatility or fluctuation traders

Glossary Series : Earnings per Share

Earnings per share or EPS is an important financial measure, which indicates the profitability of a company. It is calculated by dividing the company’s net income by its total number of outstanding shares. It is a tool that market participants use frequently to gauge the profitability of a company before

Glossary Series : Beta

Beta is a numeric value that measures the fluctuations of a stock to changes in the overall stock market. Beta measures the responsiveness of a stock's price to changes in the overall stock market. On comparison of the benchmark index for e.g. NSE Nifty to a particular stock returns, a

Glossary Series : Volatility

It is a rate at which the price of a security increases or decreases for a given set of returns. Volatility is measured by calculating the standard deviation of the annualized returns over a given period of time. It shows the range to which the price of a security may

Glossary Series : Rights Issue

A Rights Issue is a method through which companies can raise additional capital from their existing shareholders. Normally these stocks are offered at a discounted price than the existing market price. The Right Issue is attractive because the existing shareholder gets profit probably at the outset itself. It would be

Glossary Series : Repo and Reverse Repo Rate

Repurchase Option rate abbreviated as Repo Rate is the rate at which the Central Bank of a country (In India-Reserve Bank of India) lends short-term money to commercial banks. The RBI adjusts the Repo rate to control Inflation. The Monetary Policy Committee of the Reserve Bank of India decides what

Economic Moats

Moat is a ditch around the castle .It is filled with water that makes it difficult to attack for the enemies to attack the castle. The Concept of the Moat in Investing was propounded by Warren Buffet himself. Warren Buffet advises finding stocks with strong Economic Moats. If a stock

Glossary Series : Blue Chips

A blue-chip is a stock with a good reputation for quality, reliability, and the ability to operate profitably in good and bad times. These stocks are known to have the capabilities to endure tough market conditions and give high returns in good market conditions. They withstand the pressures of the

Glossary Series : Market Capitalisation

Market capitalization is the aggregate valuation of the company based on its current share price and the total number of outstanding stocks. Market Capitalisation = Current Share Price * Total Number of Outstanding Stocks For Example: If the Current Share Price is Rs.100 and the total Number of Outstanding Stocks

The Three Major Financial Statements

There are three major statements that form the three pillars of Corporate Accounting. They can be found in the Annual Report of the Company. The Three statements The Balance Sheet The Income Statement The Cash Flow Statement give the essential data to arrive at the ratios. Those ratios form the

Annual Report

The annual report (AR) is a yearly publication by the company and is sent to the shareholders and other interested parties. The annual report is published by the end of the Financial Year, and all the data made available in the annual report is dated to 31st March. The Annual Report

Different Series in National Stock Exchange

Various stocks have letters like EQ, BE affixed to them. They denote the series to which they belong in National Stock Exchange (NSE). EQ – Intraday Trading is allowed in this series. Trading using Margin and Market Orders is permitted in this category of stocks. BE – Shares trading in

Circuit Limit in Stock Market

They say about the Old Wild West that, "There are a million ways to die in the West". They also say "There are a million ways to lose money in the Market". The Capital markets are subject to a high amount of volatility and there are always big players who

The Piotroski Score

The Piotroski Score - Defined The Piotroski Score otherwise called the Piotroski F-Score was devised by Joseph Piotroski, an Accounting Professor from the USA. The Piotroski Score is a score between zero and nine that employs nine different financial parameters to find out the financial strength of a company. A

Graham Number in Value Investing

Graham Number - Defined The Graham number (not to be confused with Graham’s Number in mathematics) attempts to find the fair value or the maximum price that an investor can pay for a particular stock by taking Earnings per Share (EPS) and Book value per share (BV/Share) into consideration. Any price below the

Fundamental Analysis vs Technical Analysis

The Fundamental Analysis aims at finding the right intrinsic value of the stock and the right valuation whereas the Technical Analysis aims at finding the right entry and exit signal for a stock. The Fundamental Analysis analyses the Financial statements such as Profit and Loss Statements, Balance Sheets, Cash Flow

Pro Tips for Novice Traders

Trading is not gambling: Look at trading as a profession and not a Casino where you can mint money. It is a risky business but nevertheless, it is a business. Every Business is founded on principles, rules, and discipline. Therefore, unless you learn the systems and processes of this business,

Investment Tips for Beginners

1. Making money is about system solving, not working hard. 2. Make money while you sleep or you will never be rich. 3. It takes the same amount of effort to make 10 lakhs or 1 crore. 4. Ideas are worthless without extended execution. 5. Instead of cutting down costs,

Difference between TDR and STDR in Fixed Deposits

Normally, Fixed Deposits are broadly classified into two different types, TDR (Term Deposit Receipt) and STDR (Special Term Deposit Receipt). The primary difference between both depends on the cumulative nature of the interest payout. Term Deposit Receipt This Fixed Deposit is known as a cumulative Fixed Deposit. This kind of

Top Malayalam Band Songs of this decade

The following are the list of a few Malayalam music videos that I got addicted to in the past few years. They have predominantly featured in Music Mojo Program by Kappa TV (An amazing program that shows versatility from Carnatic to Rock Music). The past several years, especially, from the

My Top Shelf Book Recommendations

"Top-Shelf" is a phrase used to describe something of superior and excellent quality and the word literally also means 'picked from the Top-Shelf'. According to www.merriam-webster.com and other dictionaries, the Top-shelf in American usage means “of a high and excellent quality”. However be warned that, in British usage, the word

After Market Orders

“After Market Orders” feature and its advantages and disadvantages are going to be discussed in this write-up. “After Market Orders” or AMO is an order feature offered by certain brokerage houses. As the name suggests, these orders can be placed by a trader after the regular market hours in any

My favorite story from “The Alchemist”

A merchant sent his son to learn the Secret of Happiness from the wisest of men. The young man wandered through the desert for forty days until he reached a beautiful castle at the top of a mountain. There lived the sage that the young man was looking for. However,

How to invest in NIFTY?

Nifty is not an individual company. Nifty is an index that depends on the performance of the stocks comprised in the Nifty. Therefore the performance of the Nifty is dependent on those stocks which are known as the underlying asset. So you cannot buy Nifty just like you buy a

The Simple Ways to Waste {Wait} Time Usefully

There will be times when you are forced to wait on somebody or something. You will have no choice but to wait. The monotony of waiting can be frustrating also. Be it waiting at a Bus Station for your ride or waiting for your date at a restaurant, there is

How to write a book like Chetan Bhagat

1) Setup the story in a small town background such as Ahmedabad, Varanasi, Madurai, etc, and more particularly the lead characters must emerge from a middle-class background. 2) You need 3 male protagonists in their early 20s and one of them should mandatorily be the narrator of the story. (Bear in

How to avoid procrastination?

Procrastination is the habit of delaying a particular task beyond the time it should have been done. Procrastination serves as the arch-nemesis of productivity. Just like arsenic, this habit is a slow poison that would kill your efficiency even before you know it. “Hamlet” is a tragedy because he was

The Witcher – Season 1 : Ending Explained

Prologue This article is for those who have been initiated to the Witcher lore. I proceed with the assumption that the uninitiated are already on their way to watch the series. If not, beware of the massive spoilers and do not blame me

Simple Scalping Strategy for Intra Day Traders

This strategy aims at making a Nominal Day Trading Income through “SCALPING”. The Indicators that you need are “Super Trend”, ”Relative Strength Index”, ”Fibonacci Retracement Pivot Levels” and ”Volume Chart”. Try to enter into only High Volume Stocks in which there is good movement in the day. I prefer only

What it takes to be lonely

I speak volumes about women empowerment I speak at length about treating women with respect I dream of freedom in its truest sense Living by myself and exploring the horizons I dance away my blues Feeling almost confident that I am fit to walk a lonely path Speaking of marriage

Bracket Order : Should you use it or not?

A Bracket Order is an intra-day product that will allow you to place three orders simultaneously. Those three orders are: Entry Order, which is a Limit Order Exit Order, which could be your Target Order. (meaning profit) Exit Order, Stop Loss Order which can also be a Trailing Stop Loss

Legion – Was it that bad?

I happened to watch this 2010 movie yesterday. After watching the movie when I visited IMDB and Rotten Tomatoes, I was surprised to find that this movie was thrashed and beaten like an old rag by reviewers. Tomatometer reads 19 % and I don’t agree with that. I enjoyed watching

Types of Jurisdiction of the Indian Courts

Jurisdiction – It is the authority of a court to hear and adjudicate on a particular matter. The Basic Types of Jurisdiction are as follows (The List is not all encompassing): Subject Matter Jurisdiction: It means that a specific subject on which a court has powers to adjudicate. For Example:

When will the obligation of a hindu husband to pay maintenance to wife end?

Only in the following conditions, the husband can be exonerated from the liability of maintenance after it is ordered. Death of the wife Remarriage of the wife Proven adultery on the part of the wife When the wife by herself relinquishes maintenance Certain incapacities of husband such as insanity P.S: The husband

Financial Emergency in India

While a discussion on whether Financial Emergency under Article 360 of The Constitution of India should be declared is making rounds and with the country going into Lockdown for 21 days, it is time to visit the salient features of the Financial Emergency Provision. The Financial Emergency is one of

Ways to build an Emergency Fund ?

Buy a Piggy Bank Although it sounds very simple, I believe this is the most effective of all the methods. I have a practice…. Every night after coming home from Office, I just throw all the coins that are in my pocket and wallet into the piggy bank. I also

How to make a good day plan

Be clear at the target for the day. Let your target be realistic, well defined and achievable in a day. There is no point in putting “to learn Spanish” in your Day Plan. Break the tasks into small chunks with time specifications. Moreover try to make the plan before retiring

The 5S Principle

When for the first time I came across this principle as a young college student, I had even made fun that why such simple things are bombastically told as “the Principles”. But then years after and experiences later, I have understood a simple truth that “Simplicity is the ultimate form

5 places not to miss in your visit in Madurai

I often see people visit Madurai with only Meenakshi Temple in their focus. They stay for a day and go to only the Meenakshi Temple. At best, they can only visit the Thirumalai Nayak Palace in their cramped schedule. But I would say if you are prepared to stay for

Tips before you buy Life Insurance

Insurance is not Investment Insurance is not at all Investment. The basic premise is Investment is for you, But Insurance is for your family. We easily forget this and mix up both. In fact that is the reason why Term Insurance is advocated as the best type of Insurance. The

The Names of India from History

1. Meluha Much popularised by Amish's Magnum Opus, "The Immortals of Meluha", the name in true sense refers to the Indus Valley Civilisation. Found in Mesopotamian Ancient scripts, the defense throws light on the trade connections between Meluha and Mesopotamia. 2. Bharatha Varsha India as land known to be ruled